Know how to develop insurance app like Zego to achieve the early breakthrough.

Because of customer acquisition or thin market problem, If a thought to go for insurance mobile app development makes your blood run cold, the business story of a London-based InsurTech startup may inspire you. Zego, an on-demand insurance providing company which has recently raised $42 million, is targeting users from a totally different economy, Gig economy and generating revenue in millions. How? Let’s find out.

In this blog, we will discuss,

- Recent funding details of top InsurTech companies

- Insight into Zego and how much it has raised?

- Top app features you need to ask insurance app development company to integrate into your app

- How much does it cost for insurance mobile app development?

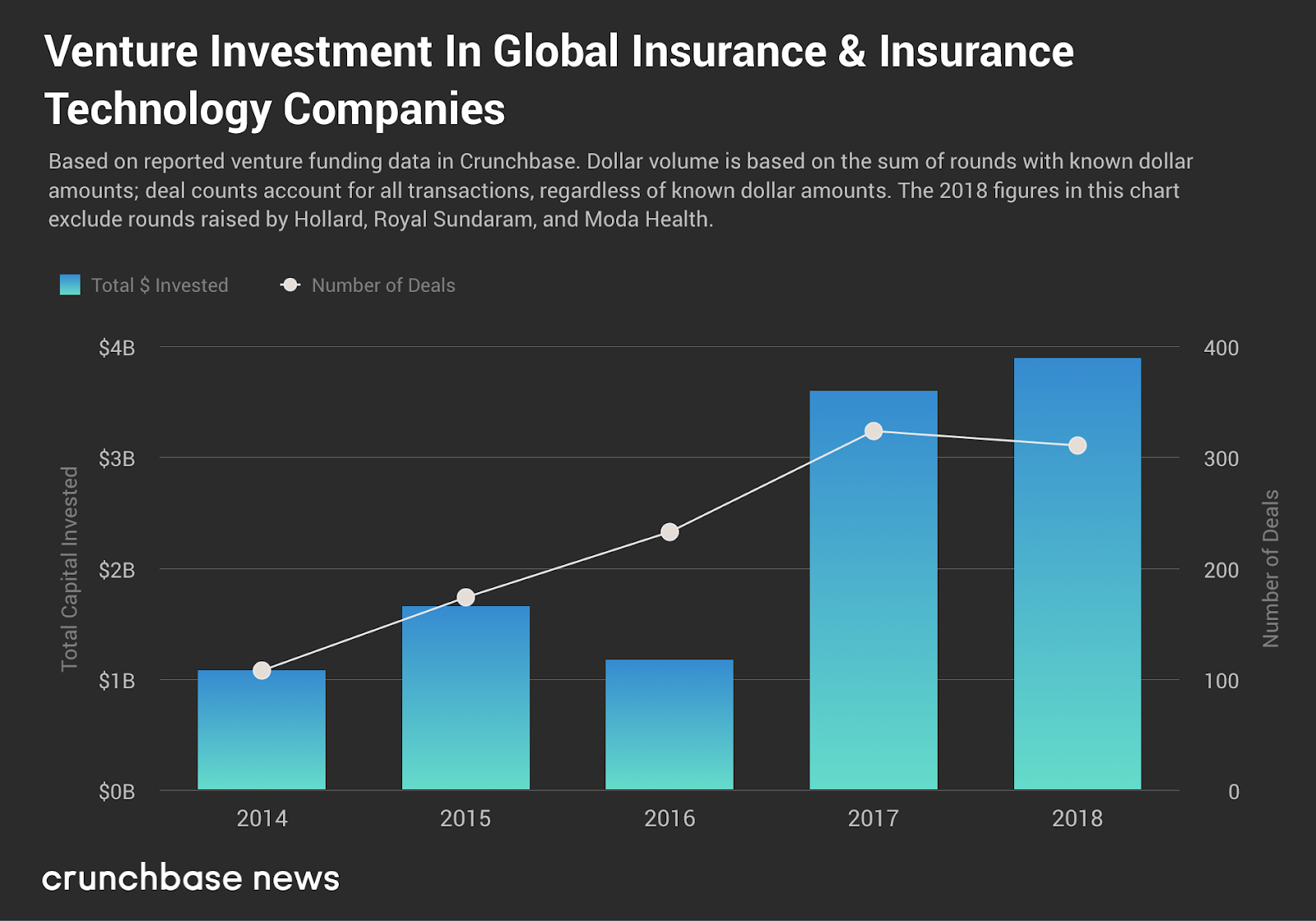

Recent funding details of top InsurTech companies

InsurTech has been attracting interest from entrepreneurs, investors, and incumbents. A China-based Zhong has raised a whopping $930 million. Another InsurTech startup named Oscar which is New-York-based raised $400 million. With tons of investment, this industry is becoming more customer-centric and cost-efficient.

Following are the recent funding news of top InsurTech companies.

► Bright Health

Bright Health is the US-based top health insurance providing company. Since early 2016, it has raised $440 million from the investors like Meritech Capitals, Bessemer Venture Partners, Greycroft, NEA and Redpoint Venture.

► Root insurance

Root is another US-based InsurTech company which offers insurance for cars based on how users drive the car. Recently, it has raised more $100 million in its series D of the funding round which was led by Tiger Global Management. With this funding round, Root’s valuation hit $1 billion.

► Hippo

Hippo is the tech-enabled home insurance providing company which has raised total $109 million, including $25 million of series B funding round and $70 million of series C funding round which was led by Lennar Corporation and Felicis Ventures.

► Setoo

Setoo is the UK-based business insurance providing company. By now, it has raised a total $12 million from the investors like Kamet and AXA’s InsurTech startup studio.

After knowing how much of funding top InsurTech companies have raised, now let’s discuss an InsurTech company named Zego in the most comprehensive way.

Insight into Zego and how much it has raised?

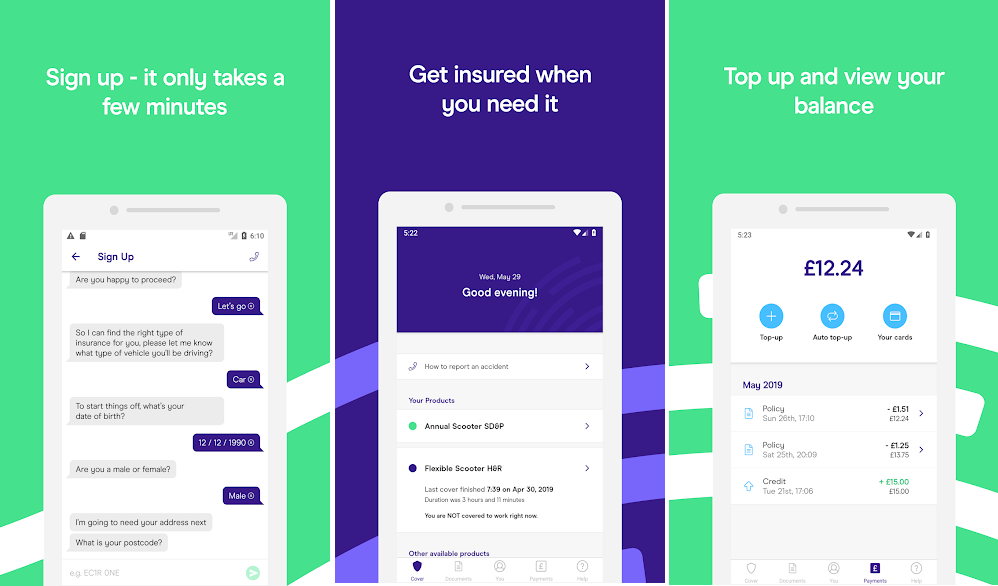

Zego is the London-based InsurTech startup which was founded by two former directors of the Deliveroo, Britain’s largest food delivery company. While they were working for Deliveroo, they came across several problems of gig workers. One of the problems gig workers were facing that time was that they had to purchase an insurance policy to work for the Deliveroo and since there wasn’t any dedicated InsurTech company for gig workers, they had to pay a large amount to get rewarded with insurance. To eliminate this deep-rooted problem, Sten Saar and Harry Franks developed an Insurance mobile app and deployed their very inexpensive insurance service for the gig workers and even for the fleet owners.

2 years ago, in its series A of the funding round, Zego has raised £6 million from Balderton Capital and Local Globe. Recently, they have raised more $42 million in their series B of the funding round. This is one of the largest funding rounds for a Europe-based InsurTech startup. According to the CEO of the Zego, they will use this amount to expand their business processes across Europe and to hire more staff.

Which are the services Zego is providing?

Zego’s insurance services are categorized mainly in two categories. These are insurance for riders and drivers and insurance for the fleet owners.

Scooter insurance is designed for food delivery drivers and courier driver. User can select the type of insurance from the available options like fully comprehensive, third party theft, and third party fire and theft. However, Zego is providing insurance for those drivers only who are working with a few approved work providers such as Deliveroo, Just Eat, One Delivery and Uber Eats.

Van insurance is designed for van drivers. They can either chose the Pay-As-You-Go pricing model or a fix 30 days pricing model. If a user opts for Pay-As-You-Go pricing model, the minimum amount he has to pay per hour is £0.80 and if he opts for monthly pricing module, then he needs to pay somewhere around £120 to £350 based on the type of insurance.

Zego is also providing insurance for those delivery drivers who deliver the couriers and food on their bicycles. This is the Zego’s most affordable insurance. Moreover, it is flexible insurance which means users have to pay only for the hours they work.

Zego’s insurance for the fleets enables the fleet owner to cover any type of fleet under insurance. Zego approves the insurance request of the fleet owner after analyzing the usage and risk posed by each vehicle. Zego can cover the unlimited vehicle of the fleet under its insurance policy.

After reading the funding report and successful business story of the Zego, if you are thrilled to develop InsurTech app, there are a few top features you need to know before going for Insurance app development.

Top features you need to ask insurance app development company to integrate into your app

A robust app is perhaps the fundamental need for any startup to achieve the early milestone. Without the feature-packed app, you as a startup cannot convince users to give up on some other InsurTech app and to use your app. A research team of Coruscate Solutions has documented a few top important modules of the insurance app after studying a few popular and moneymaking insurance apps.

► Discover and explore

Allow users to explore the different insurance policies according to their needs. Make sure to add all relevant details so users can understand your services easily.

► Select product

After exploring your services, once a user has made his mind to go for an insurance policy, ask him all important details to fill.

► Payment

Integrate a reliable and efficient payment gateway to let users pay for their selected insurance policy in a very seamless way.

► Approval

Once your team approves the user’s insurance request, let him know via notification or email. Also, provide the dashboard from where users can track the status and all details of their insurance policy.

► Service

Add an easy option to connect with customer executive if the user encounters any trouble.

► Claim

Develop the module for the claim in such a way that users can easily make a claim by filling the least possible details and then, they can track the status of their submitted claim report.

How much does it cost to develop an insurance app like Zego?

Coruscate is the top FinTech app development company which develops all kinds of FinTech apps including insurance apps. Our skilled developers and designers will develop your app by utilizing the knowledge they have earned while developing several challenging apps in the past. We will not only develop your insurance app, but we will be the strategic partner of your business and assist you to be successful with a tiny mobile app. We have already successfully completed API integration with Nordic banks and so, now we can develop FinTech app within 45 to 55 business days and under $10k.

To know more about the features and cost for insurance mobile app development, visit our FinTech app development page. We also provide a free consultation. So, feel free to ask for it.